Blockchain: Massively Simplified

Richie Etwaru, discusses the opportunity and implications of blockchain as a paradigm to slow/chose the expanding trust gap in commerce. He unpacks blockchain to a level of simplicity to be consumed by those that are just starting to understand and explore the paradigm. He lays out a current state of commerce, suggesting that every company is currently at risk of being disrupted or incurring severe strain from a blockchain version of itself.

- Published in Blockchains

How blockchains could change the world

In the early 1990s, we said the old media is centralized. It’s one way, it’s one to many; it’s controlled by powerful forces, and everyone is a passive recipient. The new web, the new media, we said, is one to one, it’s many to many; it’s highly distributed, and it’s not centralized. Everyone’s a participant, not an inert recipient. This has an awesome neutrality. It will be what we want it to be, and we can craft a much more egalitarian, prosperous society where everyone gets to share in the wealth that they create. Lots of great things have happened, but overall the benefits of the digital age have been asymmetrical. For example, we have this great asset of data that’s been created by us, and yet we don’t get to keep it. It’s owned by a tiny handful of powerful companies or governments. They monetize that data or, in the case of governments, use it to spy on us, and our privacy is undermined.

What if there were a second generation of the Internet that enabled the true, peer-to-peer exchange of value? We don’t have that now. If I’m going to send some money to somebody else, I have to go through an intermediary—a powerful bank, a credit-card company—or I need a government to authenticate who I am and who you are. What if we could do that peer to peer? What if there was a protocol—call it the trust protocol—that enabled us to do transactions, to do commerce, to exchange money, without a powerful third party? This would be amazing.

Several years ago, an unknown person or persons named Satoshi Nakamoto came up with the Bitcoin protocol. Once again, the technology genie has been unleashed from its bottle. It gives us another kick at the can, another go, to try and rethink the economic power grid and the old order of things. That, to me, is how big this is. It feels like 1993.

Full interview: https://www.mckinsey.com/industries/high-tech/our-insights/how-blockchains-could-change-the-world

- Published in Blockchains

Hyperledger: The Fabric of the Forbes 50 Blockchain Community

Hyperledger, a collaborative platform created to advance blockchain technology, was founded by The Linux Foundation at the end of 2015. But what makes it so popular among corporations? Why are twenty-four of the $1bn+ companies working with blockchain, according to Forbes, specifically working with Hyperledger – when only two are using Ripple, which is surely better-known within the crypto community?

A Frameworks For Frameworks

Hyperledger has no native coin fueling activity and is neither a blockchain nor a company. One might think of Hyperledger as a platform on which its participants can build, well, other platforms. As its website describes it:

In fact, its appeal for corporations lies in what it isn’t as much as what it is. It isn’t a blockchain supporting a cryptocurrency. It isn’t a permissionless blockchain anyone can view transactions on with an explorer. And while its community loudly espouses the virtues of blockchain technology, it isn’t prescriptive about what you can and can’t do with it.

Full Article: https://cryptobriefing.com/hyperledger-fabric-forbes-50-blockchain/

- Published in Hyperledger Technology

The Future Of Data In Banking

In the mid-90s, Bill Gates said that ‘banking is necessary, banks are not.’ This sentiment has deepened among the population over the last decade, with public opinion turning against banks after the financial crisis of 2008 and technology opening up a range of new options for financial management. This has enabled startups to enter the sector at an unprecedented rate, causing a high level of disruption. Apple, Stripe, and Square are just a few of the companies revolutionizing how we pay for things, while digital currencies and peer-to-peer lenders are opening up new funding avenues for startups and SMEs. In a recent PricewaterhouseCoopers survey of more than 1,300 financial industry executives, 88% said they feared their business was at risk to standalone financial technology companies in areas such as payments, money transfers, and personal finance, and 51% said they believe they could lose as much as 40% of their revenue to standalone FinTech firms.

Full Article :https://channels.theinnovationenterprise.com/articles/the-future-of-data-in-banking

- Published in Big Data

How AI and big data will transform banking in 2019

Did you know that artificial intelligence and machine learning could detect that it wasn’t really you who just swiped your card? That’s right, systems are being developed to flag transactions that seem fraudulent, so that banks can call up consumers and take control before the damage worsens. With everything from your refrigerator to your car going smart, banking and financial services cannot afford to lag. Before this decade ends, AI and big datawill be making radical changes to the way banks serve their customers.

From creating better customer experiences and providing personalized financial advice, to automating process and administrative work as well as lower their own internal costs, banks can benefit greatly by leveraging AI and big data. Here are some of the most interesting ways AI and Big data will transform banking in 2019.

By Daniel Gutierrez : Original article

How AI Will Challenge Small Banks to Innovate

Artificial intelligence promises to change customer relationships with banks. As more customers bring devices such as Amazon’s Alexa and Google Home into their residences, forward-looking banks can offer automated services to help users perform tasks such as requesting an address change or submitting an application for a credit card or personal loan.

In a recent report on the projected impact of AI on the banking and finance industry, the World Economic Forum warns that small and midsize banks struggle to find their footing in this rapidly changing environment.

- Published in AI, Technology

Bank 4.0 and the Future of Financial Services

It is not enough to just import technologies like AI, blockchain or smartphones into existing financial services, says futurist and fintech entrepreneur Brett King. To stay in business, banks need to rethink the role their business plays in their customers’ lives. King paints a vivid picture of how Jack Ma, robo advice and quantum computing will shape the Bank 4.0.

- Published in Technology

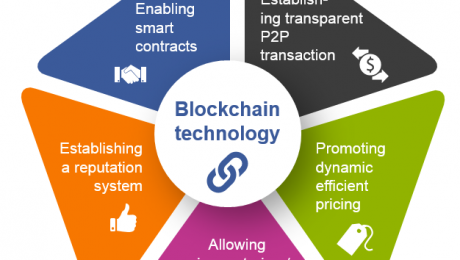

The Benefits of Blockchain Across Industries

Companies usually keep digital information secure by building a wall around data. Unfortunately, this means data is vulnerable to people who can find an access point and get inside the walls—including rogue administrators who have full access to data.

|

Transactions and data that use blockchain technology, however, do not allow changes to data once it is written unless all or a majority of participating computers agree to the change. This is a significant departure from the traditional “wall,” and decreases the possibility of backdoor transactions to nearly zero—which makes blockchain invaluable for organizations in any industry trying to safeguard their data.

What Is Blockchain?

Blockchain is an encrypted, distributed database shared across multiple computers or nodes that are part of a community or system. What makes it one of the most exciting technologies around is its ability to reduce the possibility of security breaches by even its own operators.

In a traditional implementation, a rogue administrator can potentially change historical transactions because of his or her access levels to the data. However, with a blockchain implementation across data centers, one would need a large number of teams working together across data centers to modify historical data—which greatly reduces the possibility of data tampering. The more widespread the environments, the more difficult it is to tinker with data.

Blockchain technology distributed across multiple data centers can ensure security against attacks on important network and hardware equipment.”

The financial services industry is a pioneer in exploring the uses of blockchain technology for cryptocurrency transactions. Bitcoin uses blockchain as its underlying technology. Eleven banks of the R3 consortium have already connected on the centralized Ethereum-based blockchain network. The Estonian government has used blockchain-based technology (keyless signature infrastructure) to authenticate data in their databases since 2013.

Clearly, blockchain has the ability to increase secure data exchange in other industries as well. It also has the ability to make that data transfer simpler and easier between entities.

Healthcare: Using digital signatures on blockchain-based data that allows access only when authorized by multiple people could regulate the availability and maintain the privacy of health records. In addition, a community of people, including hospitals, doctors, patients, and insurance companies, could be part of the overall blockchain, reducing fraud in healthcare payments.

Defense: Unauthorized access or modification of critical defense infrastructure, such as operating systems and network firmware, could seriously compromise national security. For most countries, defense infrastructure and computer systems are distributed across different locations. Blockchain technology distributed across multiple data centers can ensure security against attacks on important network and hardware equipment by ensuring consensus-based access for modification.

Government: Government departments that work in silos cause the exchange of information to be delayed, negatively impacting citizen services. Linking the data between the departments with blockchain ensures that data is released in real time, when both the departments and the citizen consent to sharing data. Blockchain technology could improve transparency and check corruption in governments worldwide.

Law: Blockchains can contain a huge amount of data, including entire contracts. The impact of “smart contracts”—protocols that facilitate or enforce contract performance using blockchain—will have a profound impact for industries. Smart contracts eliminate the middleman, such as a legal firm, as payment will happen based on certain milestones being met. By its very nature, the smart contract is easily enforceable electronically, creating a powerful escrow by taking it out of the control of a single party.

Subramanian Iyer, Oracle Insight and Customer Strategy. |

Energy: Microgeneration of electricity is becoming a huge trend in the power generation business. New energy initiatives such as home power generation and community solar power are filling in gaps of power supply across the world. As microgeneration adds to traditional power suppliers, it fosters creation of an energy market. Smart meters can register produced and consumed electricity in a blockchain, which allows for consumption of the surplus energy in a different location, providing credits or currency to the original producer. The credits can then be redeemed against the grid when the microgenerator needs additional electricity from the grid. The blockchain enforces these contracts in real time or near-real time, allowing for a utility market to be created with minimal red tape.

With such wide-ranging possibilities, there is no surprise that blockchain has the potential to enhance the quality of service delivery while improving confidentiality and integrity of data. With its promise of providing secure and transparent transactions, blockchain seems poised to be one of the digital world’s key pillars.

- Published in Uncategorized

8 Benefits of Blockchain to Industries Beyond Cryptocurrency

1. Supply chain management.

For supply chain management, the blockchain technology offers the benefits of traceability and cost-effectiveness. Put simply, a blockchain can be used to track the movement of goods, their origin, quantity and so forth. This brings about a new level of transparency to B2B ecosystems — simplifying processes such as ownership transfer, production process assurance and payments.

2. Quality assurance.

If an irregularity is detected somewhere along the supply chain, a blockchain system can lead you all the way to its point of origin. This makes it easier for businesses to carry out investigations and execute the necessary actions.

A use-case for this is in the food sector, where tracking the origination, batch information and other important details is crucial for quality assurance and safety.

3. Accounting.

Recording transactions through blockchain virtually eliminates human error and protects the data from possible tampering. Keep in mind that records are verified every single time they are passed on from one blockchain node to the next. In addition to the guaranteed accuracy of your records, such a process will also leave a highly traceable audit trail.

Of course, the entire accounting process also becomes more efficient on a foundational level. Rather than maintaining separate records, businesses can only keep a single, joint register. The integrity of a company’s financial information is also guaranteed.

4. Smart contracts.

Time-consuming contractual transactions can bottleneck the growth of a business, especially for enterprises that process a torrent of communications on a consistent basis. With smart contracts, agreements can be automatically validated, signed and enforced through a blockchain construct. This eliminates the need for mediators and therefore saves the company time and money.

Today, blockchain solutions like CREDITS offer autonomous smart contracts paired with its own internal cryptocurrency. By consolidating everything into a single platform, businesses can integrate services without disclosing an excessive amount of proprietary information to third parties.

Related: 3 Things Entrepreneurs Need to Understand About Blockchain Technology

5. Voting.

Just like in supply chain management, the promise of blockchains in the aspect of voting all boils down to trust. Currently, opportunities that pertain to government elections are being pursued. One example is the initiative of the government of Moscow to test the effectiveness of blockchains in local elections. Doing so will significantly diminish the likelihood of electoral fraud, which is a huge issue despite the prevalence of electronic voting systems.

Another example is when NASDAQ leveraged blockchain technology to facilitate shareholder voting. It worked with the joint efforts of their blockchain technology partner and local digital identification solutions, which provided governments with identity cards. After seeing success, they described the “e-voting” project as a practical, necessary and disruptive.

6. Stock exchange.

The notion of using blockchain technology for securities and commodities trading has been around for a while. Given the open-yet-reliable nature of blockchain systems, it isn’t surprising to hear that stock exchanges now consider it as the next big leap forward.

In fact, Australia’s stock exchange is already dead set on switching to a blockchain-powered system for their operations, which is designed by the blockchain startup Digital Asset Holdings. In a press release published in December 2017, Blythe Masters, CEO of Digital Asset, said, “after so much hype surrounding distributed ledger technology, today’s announcement delivers the first meaningful proof that the technology can live up to its potential.”

7. Energy supply.

There are two types of businesses — those that shrug off monthly utility bills and those who scratch their heads, wondering where their energy expenditures are coming from.

In certain parts of the globe, commercial establishments and households can now take advantage of blockchain-enabled “transactive grids” for sustainable energy solutions that accurately track usage. A couple of examples would be Powerpeers in Netherlands and Exergy in Brooklyn. Blockchain can also be used to improve the tracking of clean energy. After all, once power is sent to the grid, no one can really discern if it’s generated by fossil fuels, solar energy or wind.

Traditionally, renewable energy is tracked through tradable certificates that are issued by the government. These certificates are, to put it bluntly, terrible in serving their purpose — something that blockchain would have no trouble handling.

Related: Why You Can’t Afford to Ignore Cryptocurrencies and Blockchain Anymore

8. Peer-to-peer global transactions.

Finally, the meteoric rise of Bitcoin and every other cryptocurrency in the market isn’t without merit. For one, it enabled the fast, secure and cheap transfer of funds across the globe.

While there’s already a slew of services like PayPal that process international payments, they usually require sizable fees per transaction. Other P2P payment services also have specific limitations, such as location restrictions and minimum transfer amounts. That’s why more businesses, as well as regular users, are beginning to prefer cryptocurrency for international transfers. Not only are they generally more secure, users are also granted more freedom when it comes to the movement of their funds. It’s clear that the blockchain is making strides into different industries outside of cryptocurrency. One could argue that most people aren’t ready yet for decentralized digital ledgers, but looking at blockchain’s progress thus far, it probably won’t be long before non-adopters follow suit.

- Published in Technology

What is Blockchain Technology?

Is Blockchain Technology the New Internet?

The blockchain is an undeniably ingenious invention – the brainchild of a person or group of people known by the pseudonym, Satoshi Nakamoto. But since then, it has evolved into something greater, and the main question every single person is asking is: What is Blockchain?

By allowing digital information to be distributed but not copied, blockchain technology created the backbone of a new type of internet. Originally devised for the digital currency, Bitcoin, (Buy Bitcoin) the tech community has now found other potential uses for the technology.

In this guide, we are going to explain to you what the blockchain technology is, and what its properties are that make it so unique. So, we hope you enjoy this, What Is Blockchain Guide. And if you already know what blockchain is and want to become a blockchain developer please check out our in-depth blockchain tutorial and create your very first blockchain.

- Published in Posts, Technology

- 1

- 2